Acquiring A Franchise In Need of a Turn Around: A DEEPER Dive: Buying a Franchise vs Independent Businesses

This Week On How2Exit, Chatting With An Expert About Buying A Franchise That Was In Need Of A Turn Around - DEEPER - Buying a Franchise vs Independent Businesses

Together with ITX M&A Marketplace - click here to sell your MSP Company (Sponsor)

Before We Begin - Join Us, Hang Out with our expert guests from all over the world, network, make new connections, and move your game forward. - Join Here

This week on How2Exit:

E125: Foot Solutions CEO John Prothro on Acquiring and Growing a Foot Wellness Franchise

Summary/Abstract

John Prothro, CEO of Foot Solutions, shared his journey from M&A advisory to acquiring Foot Solutions and the challenges he faced. When Prothro acquired the business, it was a small company with a dying brand, but he saw it as an opportunity to turn it around. Prothro plans to expand Foot Solutions by bringing some of the franchisees in-house, driving up revenue, and putting money back into marketing and overall expansion.

Prothro emphasized the importance of being Medicare accredited as a foot solutions company and how it is best practice to have at least one Medicare-accredited location in each area. He also discussed the importance of understanding the power structures and communication levels within the organization. Skelton and Prothro agreed that knowledge, influence, and power are essential components for getting things done in a company, and that it is important to identify who has each of those components and how they work together.

Despite acquiring Foot Solutions one week before the first Covid death was announced, Prothro says the pandemic was overall fairly good for the business as they were a new ownership group and the brand had gotten off track. They did a whole rebrand and spent time getting to know franchisees better, building a culture of collaboration and teamwork.

Prothro plans to focus on the US market and bring in more franchises while also being acquisitive. They have partnered with a company in Canada to grow the Canadian market. Foot Solutions is focused on building the brand in regional hubs and has a handful of hubs that they are actively looking at. Prothro believes in growing as fast as they can while still maintaining quality.

Prothro stressed the importance of having an infrastructure in place for the business to operate without the owner, especially for small businesses. He also discussed the importance of having someone in place to take over the main role when selling a business. Prothro works with a lot of chiropractors, podiatrists, physical therapists, and orthopedics, and they receive a lot of referrals from them.

When it comes to acquisitions, Prothro looks for value beyond just inventory and a customer list. He believes that the main thing to look for in a future acquisition is the center of gravity to not be the people who are leaving but the business itself. Prothro's experience in turning around Foot Solutions has given him valuable insights into the importance of understanding the people and power structures within a business, as well as the need for collaboration and teamwork to drive growth and success. Despite the

Don’t have time to what the show. Read what we learn in our AI-supported article here: 11 Concepts We Can Learn About Turn Arounds and Growth From How2Exit's Interview W/ John Prothro

—SPONSORS—

For an Awesome source of information and great articles on buying, growing, and selling a business, check out: Acquisition Aficionado Magazine’s Latest Issue (Sponsor)

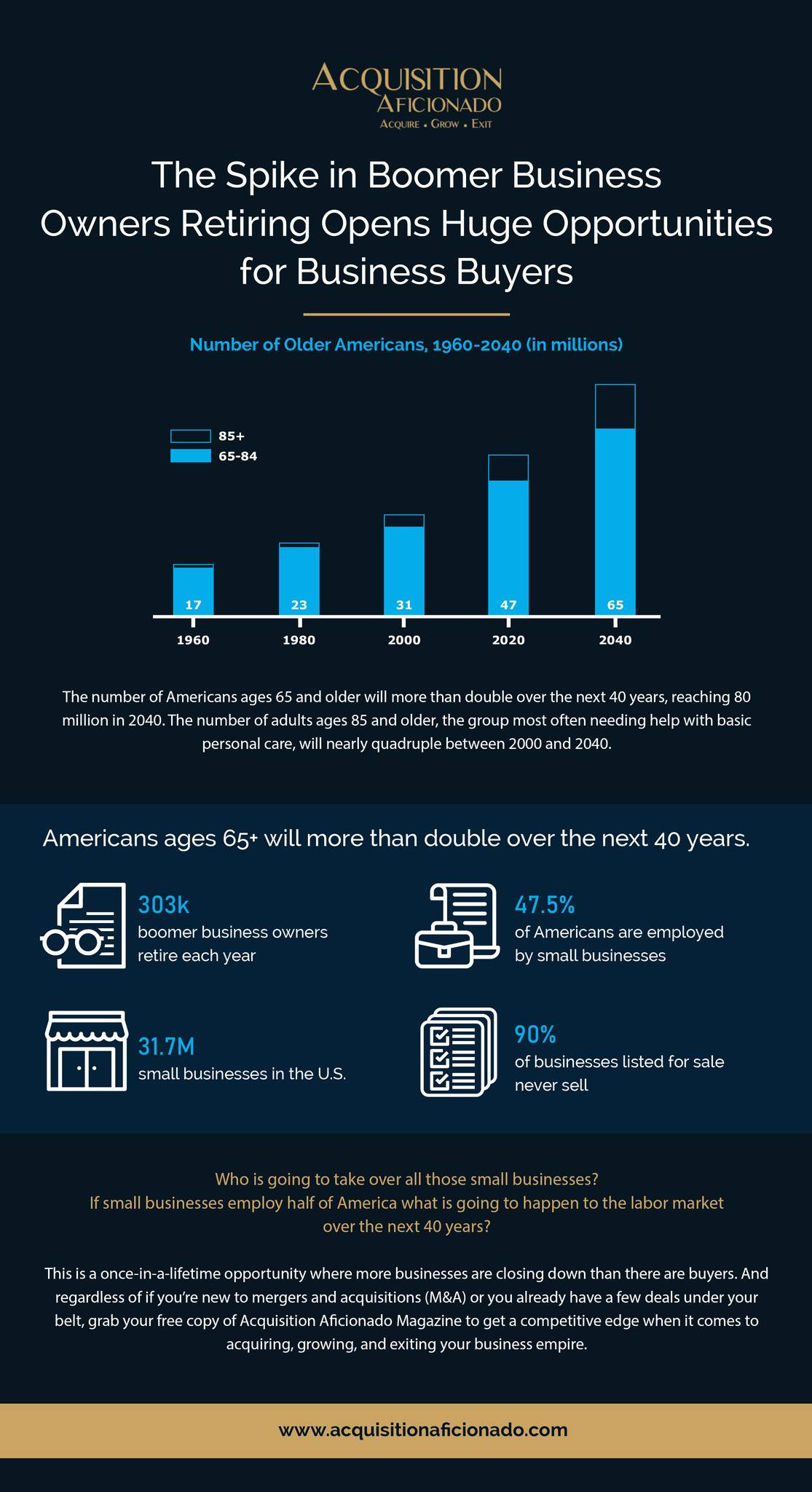

10,000 baby boomers are retiring every single day... many of them, business owners. The opportunity to grow your wealth and/or scale your existing business through acquisitions both NOW and in the future...Is MASSIVE. 🤯

There will simply not be enough dealmakers to capture this historic transfer of wealth. Taking advantage of this "Wind at your back" time period is paramount for those building their personal empires!

How2Exit together with Acquisition Aficionado Magazine are your top resources for M&A industry news, keep up on the top tactics and strategies now by visiting our website to download your free copy - https://lnkd.in/g6Eg4usi

The Hub Main Street M&A - News Newsletter

Attention Business Brokers, Advisors, Acquisition Entrepreneurs, and SMB Owners!

Do you want to stay ahead of the game in the SMB M&A market? The Hub is the solution you need! This curated newsletter brings you the best highlights from blogs, podcasts, YouTube, and news sources, all in one place. The HUB

Founding Member Shout-Out

Thanks to Sweetview Partners, an Acquisitions company looking to buy Texas-based B2B companies in the $1MM - $30MM revenue range. Click on the logo to check them out.

This week’s “DEEPER” Dive: Buying a Franchise or an Independent Business. A Comparative Guide for Buyers.

In the vast landscape of business opportunities, two paths distinctly stand out for aspiring entrepreneurs – buying a franchise or an independent business. Each route, diverging in its own direction, carries its unique set of advantages, challenges, and demands. This article serves as a compass, guiding you through this critical decision-making process.

The choice between buying a franchise and an independent business is not merely a financial decision; it's a decision that will shape your lifestyle, work habits, and future. It's akin to choosing between following a well-marked trail or venturing off into the wilderness, carving your own path. While both can lead to the peak of success, the journey and the skills needed to traverse each are significantly different.

Let’s dive in.

Read the full article by the Author, Ronald Skelton, with a paid account, click the share below and tag me in your share to get a paid account for a week, refer 3 people (DM me on Linkedin who you got to sign up), and get a paid account for 90 days. Get 10 signups - FREE FOR A YEAR.

FROM THE Editor:

Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. We are not attorneys, tax, or financial advisors and not qualified to give any such advice.