Lawyers, Partners, and Hidden Information

This Week On How2Exit and Negotiations tactics from Black Swan Coach : Derek Gaunt:

Together with ITX M&A Marketplace - click here to sell your MSP Company (Sponsor)

E94: Hans Sperling Discusses Mergers & Acquisitions Transactions And Provisions

Summary/Abstract

Hans Sperling is the founder and principal of Sperling Law Corporation, a business law firm. He has been in the space for over 20 years and has worked on deals ranging from six figures to hundreds of millions. He originally thought he would pursue a career in maritime law, but ended up in business law when he got a job with a firm in Japan. He enjoys the deal side of law more than the litigation side, as it is more positive and exciting. He enjoys the challenge of each deal being different and the positive energy of everyone involved in the deal.

Ron and Hans are discussing the similarities and differences between six-figure and hundred-million-dollar deals. They both agree that the contracts are similar and that due diligence can vary greatly.

Business owners should be aware of the importance of due diligence when signing contracts. The contract should be broken down into three parts: the basic deal, reps and warranties, and miscellaneous. The basic deal should include the agreement of what is being bought and what is being paid. Reps and warranties are more technical aspects of the contract and should be carefully reviewed. The miscellaneous section should include clauses that validate the contract in certain states and ensure that the rest of the contract is not rendered invalid if a certain clause is thrown out.

Watch the interview here:

Check out: Acquisition Aficionado Magazine’s Latest Issue (Sponsor)

E93: CEO Robert Nance Shares Tips On Acquisition Entrepreneurship And Business Buying.

"Robert Nance Takes A Partnership-Focused Approach To Small Business Acquisitions"

Robert Nance, the CEO of Malu Investment Group and the Small Business Acquisitions Group. Robert started in the investment world by buying 125 pieces of property in Dallas in the 1990s. This included a Mexican meat distributor doing $6 million a year in sales which he turned into a successful business.

Robert's current focus is on partnering with individuals to buy businesses in the US. He's looking for individuals between the ages of 35 to 50 who have been in management for five years and are ready to step out on their own.

His model of partnering is proving to be successful in the post-Covid world. His model is different from the standard approach of taking a course and buying a business because he does not sell courses. He only makes money when he buys a company, and he has a network of CEOs, CFOs, and Directors of Sales that are outsourced to help partners.

Nance negotiates every single deal, and he teaches the buyer how to create a pipeline of companies to buy. Watch the episode here:

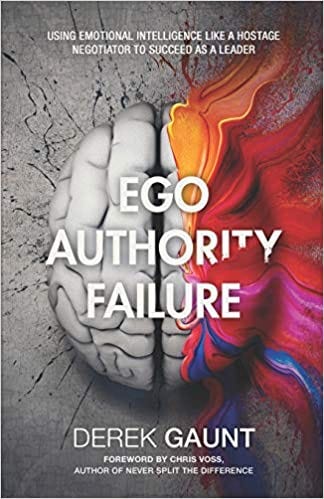

This week’s “DEEPER” Dive: Negotiations with Chris Voss/Black Swan Coach Derek Gaunt - Author of “Ego, Authority, Failure.”

Back in Episode 41. We interviewed Derek Gaunt, a former hostage negotiator and discussed tactical empathy and the key to finding what your seller might be hiding. Today we dive “DEEPER” —- This article highlights the importance of Tactical Empathy in M&A transactions, which is the ability to recognize and articulate the perspectives of the seller. The guest, a former hostage negotiator, explains that every seller hides information, but the key to uncovering the secrets lies in using Tactical Empathy to listen for emotional, logical, or identity issues. By doing so, the buyer will be able to uncover what the seller may be hiding, which can prevent a deal from falling through. - Upgrade now for the deeper dive:

—SPONSOR—

Attention Business Brokers, Advisors, Acquisition Entrepreneurs, and SMB Owners!

Do you want to stay ahead of the game in the SMB M&A market? The Hub is the solution you need! This curated newsletter brings you the best highlights from blogs, podcasts, YouTube, and news sources, all in one place. The HUB